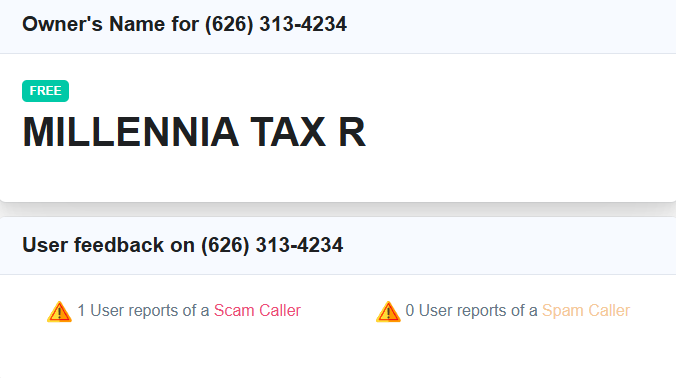

Scam Numbers: (413) 279-0360, (802) 386-0186 & (626) 313-4234

Carriers: Commio (413 and 802), Onvoy (626)

Call Center Location: United States of America ![]()

Answers as: “The tax support help L line” or “Tax Support”

The scammers attempted to send a ringless voicemail to my Google Voice line through their Commio number:

“Hi, this is Corey with MTR Tax Support. I’m calling to let you know that if you are an individual or business owner with unresolved personal or business tax issues, there are us and state Fresh Start programs that can help. Our team of tax professionals can help you get back on track with taxing agencies and assist you in reducing or eliminating tax liability. Call 626-313-4234 now for more information on how to deal with outstanding tax issues. Again, that’s 626-313-4234. Thank you.”

I called their Onvoy number and the call was answered by an American who refused to give the true identity of their company, instead opting to answer as “Tax Support.” Unfortunately for them, I was able to trace their number back to Millennia Tax Relief, LLC at 15000 Nelson Ave East, #200, City of Industry, California 91744-4331.

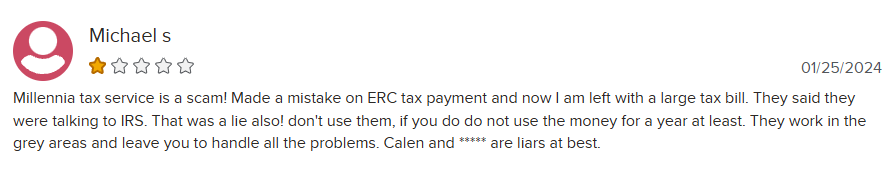

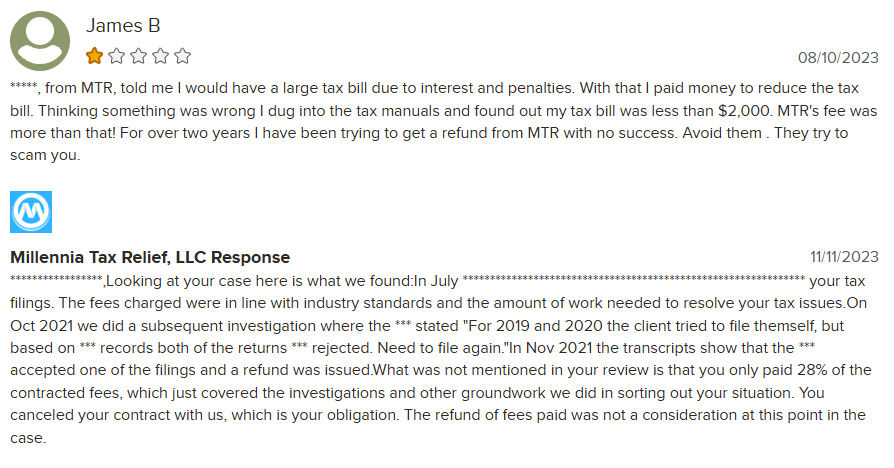

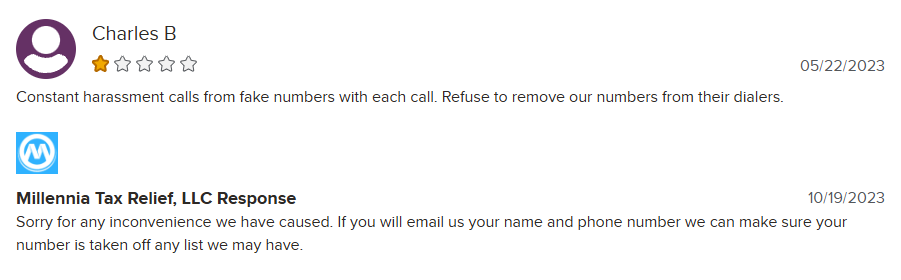

While the company is accredited with the Better Business Bureau, user complaints on their BBB and TrustPilot listings, as well as their Facebook profile, indicate patterns of fraudulent activity, such as:

- Falsely claiming to be in communication with the IRS.

- Refusing to offer refunds

- Repeatedly making unsolicited cold calls from fake numbers and refusing to maintain an internal do-not-call list.

On April 20, 2023, the company was sued in the Middle District of Pennsylvania for violations of the Telephone Consumer Protection Act (TCPA) after the plaintiff, Zachary Fridline from Northumberland, Pennsylvania, received unsolicited cold calls and ringless voicemails from the company since November 2021 whilst his number was on the do-not-call registry. As the company failed to show up for their trial, The court issued a default judgment in Fridline’s favor on March 29, 2024 and the company was ordered to pay $15,000 for 10 confirmed violations.

https://caselaw.findlaw.com/court/us-dis-crt-m-d-pen/115998026.html

https://www.casemine.com/judgement/us/66093de20c096e5d6413de0c

https://www.pacermonitor.com/public/case/48578057/Fridline_v_Millennia_Tax_Relief,_LLC

The company was also sued for TCPA violations in Arizona and the Central District of California, where default judgments were issued, and the Eastern District of Arkansas.

https://www.courtlistener.com/docket/67631750/knox-v-millennia-tax-relief-llc/

https://www.courtlistener.com/docket/67939024/dawn-costa-v-millennia-tax-relief-llc/

Associated Facebook Account - Redirecting...

Associated LinkedIn Accounts:

- Millennia Tax Relief

- Kenny Mendoza, Case Manager

- Juan Fabela, Sales Consultant

- Zaryab Choudhry, Sales Rep

- Octavio Hernandez Jr., Finance/Underwriter

- Karen Summers, ERTC Specialist and Senior Tax Analyst

- Rakib Nilu, Inside Sales Rep

- Art Juarez, Senior Manager for Business Solutions

- Michael Green, Business Development Executive

- Darren Hanzy, Account Manager

- Diedra M., Customer Service Rep

Associated Phone Number - (800) 697-7702 (RingCentral)

Associated Email Address - [email protected]